Protects Account from Unexpected Moves in Forex Trading

A Complete Guide

1.0 Introduction

If you’ve been trading Forex for a while, you already know one truth: the market doesn’t always move the way we expect. A simple news update, sudden interest rate decision, or geopolitical tension can cause a huge price swing in seconds. Many traders lose their accounts not because they’re bad at analysis, but because they don’t know how to protect their money from unexpected moves.

In this article, we’ll go beyond the basics and talk about practical, advanced but easy-to-use strategies that will help you safeguard your account, manage risk like a pro, and survive in any market condition.

2.0 Why Unexpected Moves Are Dangerous

The Forex market trades 24/5, and during this time, several things can trigger volatility:

Economic news like Non-Farm Payrolls (NFP), CPI, or central bank speeches.

Liquidity gaps during market opening and closing hours.

Broker slippage when spreads suddenly widen.

Emotional reactions from traders chasing the market.

If you’re not prepared, one wrong trade can wipe out weeks or even months of gains. That’s why protection must always come before profit.

1.1 The Power of Stop-Loss – Your Safety Net

A stop-loss is not just a tool—it’s your insurance in the Forex market.

Always set a stop-loss before placing a trade.

Avoid setting it too close; the market often makes small fake moves.

For better results, place your stop-loss beyond key support/resistance zones.

👉 Pro Tip: Use a trailing stop-loss. Once your trade is in profit, the trailing stop automatically locks some profit if the market turns.

1.2 Smart Risk Management – Trade Small, Trade Smart

The fastest way traders blow accounts is by risking too much on one position. Professionals follow the 1–2% rule:

If your account balance is $1,000, risk only $10–20 per trade.

Keep lot sizes realistic, especially when using high leverage.

Think long-term: it’s better to survive 100 trades with small risk than blow your account in 3 trades.

✅ Advanced tip: Use a position size calculator to avoid guessing lot sizes.

1.3 Hedging and Diversification – Don’t Put All Eggs in One Basket

Unexpected moves don’t affect all pairs equally. That’s why diversification helps.

If you’re long EUR/USD, you could hedge with a short EUR/GBP position.

Gold (XAU/USD) often moves opposite to USD pairs—making it a good hedge.

Trade multiple pairs instead of focusing on just one.

This way, even if one trade fails, another might cover the loss.

1.4 Be Careful During News Events

High-impact news is like a storm. Even if your analysis is correct, spikes can hit your stop-loss before going your way.

Always check the Forex economic calendar before entering trades.

If you’re not an advanced news trader, avoid opening trades 30 minutes before big events like NFP or FOMC.

If you want to trade news, use smaller lot sizes and wider stops.

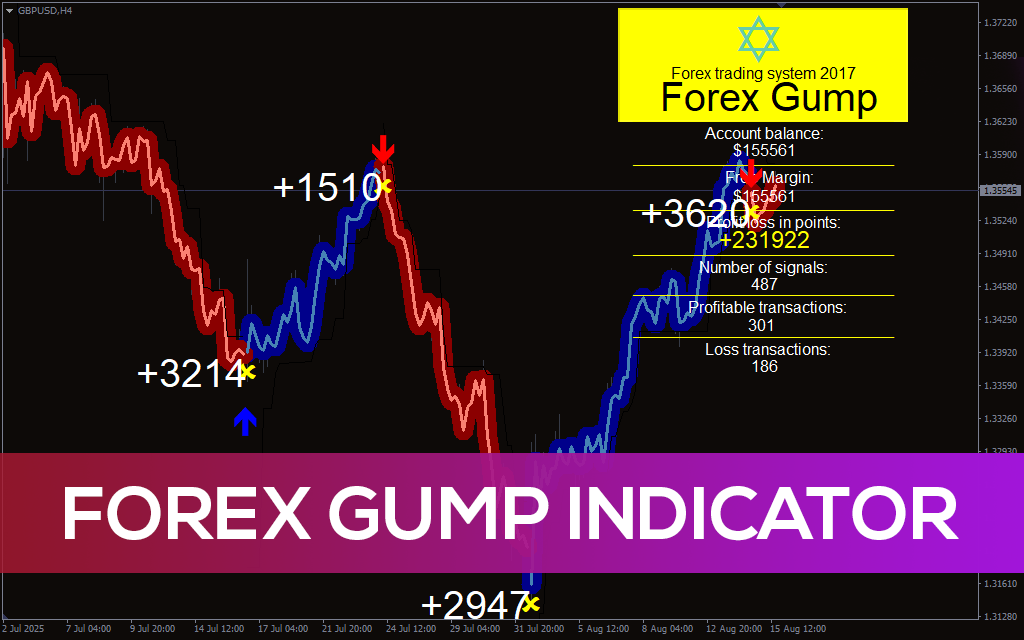

1.5 Expert Advisors (EAs) with Built-In Protection

Many traders now use automated robots (EAs) that apply strict rules without emotions. A good EA can:

Limit maximum daily loss.

Close trades if volatility spikes.

Automatically manage trailing stops.

🔗 Try these free EAs on our site:

1.6 Control Your Leverage – Less is More

Leverage is a double-edged sword. With 1:1000 leverage, a small market move can double your account—or wipe it out.

Beginners should stick to 1:10 – 1:30 leverage.

Advanced traders can use higher leverage, but only with strict stop-loss rules.

Think of leverage as a tool, not a shortcut to get rich.

1.7 Master Your Emotions – The Hardest Protection

Even with the best strategy, fear and greed can destroy accounts.

Create a written trading plan and follow it.

Set daily profit and loss limits.

If you feel emotional after a loss, stop trading for the day.

👉 Trading is not about winning every trade. It’s about staying in the game long enough to grow consistently.

2.0 Conclusion

Protecting your account from unexpected moves is not an option—it’s a must. By combining stop-loss orders, smart risk management, diversification, EA automation, and emotional discipline, you can trade safely and confidently.

Remember: profits are temporary, but capital protection is forever.

📌 Related Posts You May Like

✅ FAQ – Protecting Your Forex Account

Q1. Can I trade Forex without a stop-loss?

No. Even professional traders use stop-loss. Without it, one bad move can wipe out your account.

Q2. What leverage should beginners use?

Between 1:10 and 1:30 is safest for protecting your capital.

Q3. Do Expert Advisors really protect accounts?

Yes, some EAs include built-in features like max daily loss, auto-stop, and volatility filters.

Q4. How can I avoid losses during news events?

Check the economic calendar, close trades before major news, or use smaller lot sizes.

Recent Post

Protects Account from Unexpected Moves in Forex Trading – A Complete Guide

SIMPLIFIED PATTERN TRADING SECRETS IN 90 MINUTES BOOK PDF REVIEW

How AI-Powered Forex EAs Are Revolutionizing Forex Trading in 2025