Scalping Robot EA Review-2025 (MT4 and MT5)

The Scalping Robot MT4 & MT5 is a fully automated trading EA designed for quick, short-term scalping. It focuses on speed, precision, and strict risk management to keep trading safe. Below is an overview of how it works, its settings, and the key factors that affect its performance.

Table of Contents

What is a Scalping Robot EA?

A Scalping Robot EA is an automated trading system designed to perform scalping strategies on the forex market. Scalping is a short-term trading technique that aims to make small profits by taking advantage of tiny price movements, often within a matter of seconds or minutes. Scalping robots are programmed to execute multiple trades throughout the day based on predefined algorithms that analyze market conditions and identify high-probability entry and exit points.

The EA operates on platforms like MetaTrader 4 (MT4) and MetaTrader 5 ( MT5), which are widely used by forex traders due to their robust features, ease of use, and support for automated trading. Once activated, the Scalping Robot EA can trade without the need for human intervention, making it an ideal solution for traders who want to automate their strategies and capitalize on frequent market fluctuations.

How Does a Scalping Robot EA

Work?

A Scalping Robot EA works by utilizing specific algorithms and technical indicators to spot favorable conditions for scalping trades. Here’s how it typically operates:

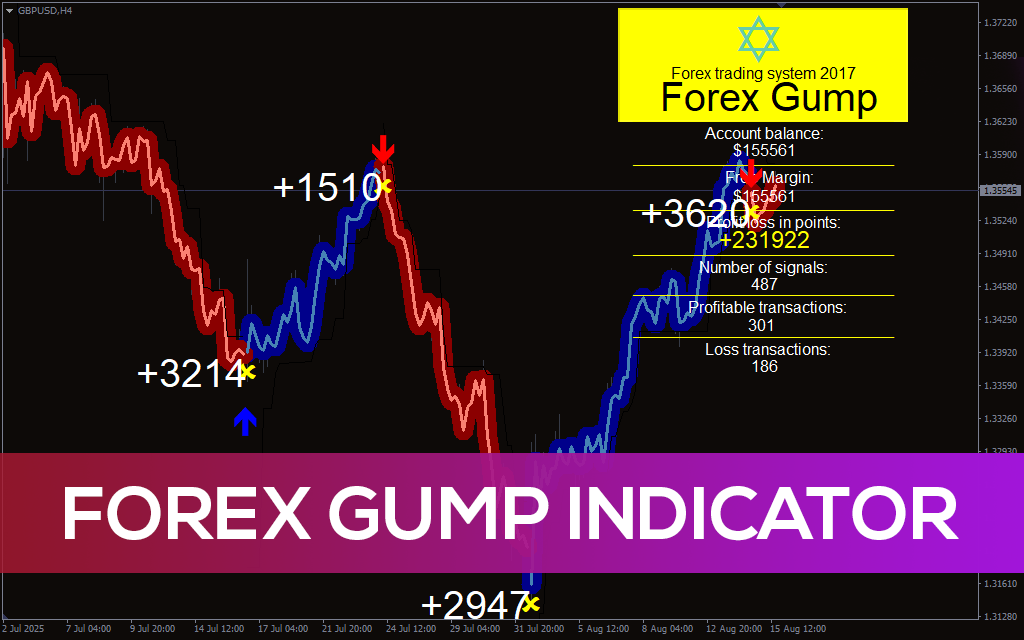

- Market Analysis: The Scalping Robot EA continuously analyzes the forex market, studying price action, trends, volatility, and indicators such as Moving Averages, Bollinger Bands, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

- Trade Entry: Based on the data it gathers, the robot identifies potential entry points where the price is likely to move in the trader’s favor. This is typically done by detecting small price fluctuations that can be exploited for quick profits.

- Trade Execution: Once an entry point is identified, the Scalping Robot EA automatically opens a position. The robot typically uses tight stop-loss and take-profit levels to minimize risk and lock in small gains.

- Trade Management: The robot constantly monitors open trades, adjusting stop-loss levels or closing positions as needed based on the market conditions.

- Trade Exit: After reaching the predetermined profit target, the Scalping Robot EA will exit the trade, securing the profit and preparing for the next opportunity.

Benefits of Using a Scalping Robot EA

1. Speed and Precision

Scalping involves making multiple trades in a short time frame, and speed is of the essence. The Scalping Robot EA can open and close trades almost instantly, far surpassing the capabilities of human traders. This allows traders to take advantage of fleeting market opportunities, ensuring no potential profit is missed.

2. Emotion-Free Trading

One of the main challenges in forex trading is managing emotions. Fear and greed can cloud a trader’s judgment, often leading to poor decisions. With a Scalping Robot EA, emotions are eliminated. The robot strictly follows the strategy and executes trades based on objective market analysis, ensuring disciplined and logical decision-making.

3. 24/7 Operation

Unlike human traders, who need rest, a Scalping Robot EA can trade around the clock. This allows the robot to take advantage of market movements at any time of the day or night, across all forex trading sessions. This continuous operation increases the potential for profits, especially in highly volatile market conditions.

4. Consistency and Reliability

A Scalping Robot EA operates based on well-defined rules and strategies, which means it can perform consistently over time. It doesn’t rely on intuition or luck but follows a systematic approach, making it a reliable tool for traders who prefer a disciplined trading style.

5. Backtesting Capability

Most Scalping Robot EAs come with backtesting features, allowing traders to test the robot on historical market data. This helps assess the robot’s performance and adjust its parameters to optimize its results in real-world trading conditions.

6. Risk Management

Good Scalping Robot EAs are equipped with robust risk management tools, including adjustable stop-loss, take-profit, and trailing stop features. These tools help control potential losses and ensure that the trading strategy adheres to the trader’s risk tolerance.

Key Features of Scalping Robot EAs

When choosing a Scalping Robot EA, here are the essential features to consider:

- High-Speed Execution: Scalping requires quick trade execution, so choose a robot that minimizes latency to maximize profits from small price movements.

- Advanced Risk Management: The ability to set stop-loss, take-profit, and trailing stop levels is crucial for managing risk and protecting profits.

- Customizable Settings: A good Scalping Robot EA should allow you to adjust parameters like trade size, risk tolerance, and strategy preferences to suit your trading goals.

- Proven Performance: Look for Scalping Robot EAs with a track record of success. Read reviews, check for backtest results, and ensure the robot is developed by a reputable provider.

- User-Friendly Interface: The Scalping Robot EA should be easy to install, configure, and use. A user-friendly interface makes it easier for traders to customize settings and monitor performance.

- Regular Updates and Support: Choose a robot that is regularly updated and comes with solid customer support. This ensures the EA remains effective in changing market conditions.

Conclusion

The Scalping Robot EA is a powerful tool for forex traders looking to automate their strategies and capitalize on small price movements. With speed, accuracy, and emotional detachment, it offers a significant advantage in the highly competitive forex market. However, like any trading tool, success depends on choosing the right robot and managing risk effectively.

By incorporating a Scalping Robot EA into your trading routine, you can enhance your profitability while minimizing the time and effort spent on manual trading. Whether you’re new to forex or an experienced trader, a Scalping Robot EA can help you unlock a new level of trading efficiency and success

Frequently Asked Questions (FAQ) – Scalping EA MT4 & MT5

What is the Scalping EA MT4 and MT5 ?

The Scalping EA MT4 and MT5 is an automated trading robot designed to trade short-term price movements in the forex market. It works on MT4 and MT5 platforms and executes trades without human intervention.

How does a Scalping Robot EA work?

It uses predefined algorithms and technical indicators to analyze market conditions, spot opportunities, and place trades automatically. The robot focuses on small price movements and aims for quick profits.

Can the Scalping EA run 24/7?

Once installed on a trading platform or VPS, it can operate day and night, capturing opportunities in different forex trading sessions without any breaks.

Do I need trading experience to use this EA?

The robot is fully automated and beginner-friendly. Even new traders can install it and let it run with preset settings. Experienced traders can customize the parameters for better results.

Which trading platforms support the Gold Scalping EA?

It works on both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), the most popular forex trading platforms worldwide.

What indicators does the Scalping Robot use?

The EA typically analyzes price action, volatility, and indicators like Moving Averages, Bollinger Bands, RSI, and MACD to identify trade entries and exits.

What are the benefits of using this EA?

Some key benefits include high-speed execution, emotion-free trading, consistency, 24/7 operation, and strong risk management features like stop-loss and trailing stop.

Is scalping risky with this EA?

Like all trading, scalping carries risks. However, the EA comes with built-in risk management tools to minimize potential losses and protect your account.

Can I backtest the this Scalping EA MT4 and MT5?

Most scalping robots allow you to backtest on historical data to evaluate performance and optimize settings before live trading.

Which currency pairs does it work best on?

While it’s optimized for gold trading (XAU/USD), it can also be tested on other major forex pairs like EUR/USD, GBP/USD, and USD/JPY.

Recent Post

Protects Account from Unexpected Moves in Forex Trading – A Complete Guide

SIMPLIFIED PATTERN TRADING SECRETS IN 90 MINUTES BOOK PDF REVIEW

How AI-Powered Forex EAs Are Revolutionizing Forex Trading in 2025